When you’re in your 30s, life comes with responsibilities — family, rent, EMIs, maybe even a child’s education. If your income isn’t high, saving money might feel impossible. However, trust me, even with a low income, you can still build savings and gradually work toward financial stability.

The key lies in small, consistent habits. Let’s dive into how to save money in your 30s with a low income, step by step.

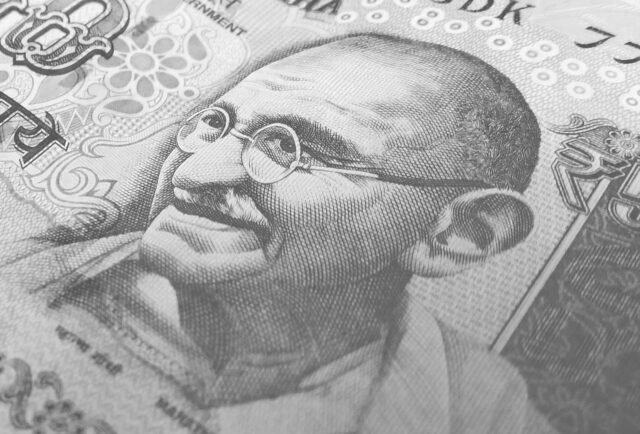

1️⃣ Understand Your Income vs. Expenses — Know Where Every Rupee Goes

“What gets measured, gets managed.”

Start by tracking your spending for at least 30 days. Use a simple notebook or apps like Walnut (now known as axio), Money Manager, or even a Google Sheet. Write down EVERYTHING — rent, groceries, coffee, online orders, OTT subscriptions, fuel.

Why?

You’ll be surprised how much leaks out through small, unnecessary expenses.

2️⃣ Budget Smart with the 70-20-10 Rule (Flexible for Low Income)

The standard 50-30-20 rule may feel unrealistic when money’s tight. So try this instead:

- 70% Essentials: rent, groceries, utilities, EMIs

- 20% Savings & Investments: savings account, RD, SIP

- 10% Lifestyle & Leisure: movies, dining out, shopping

Even saving 10% is better than saving nothing.

3️⃣ Automate Your Savings — Pay Yourself First

The biggest mistake people make? Saving “whatever is left” at the end of the month.

Flip this habit. Set up an automatic transfer of ₹1000 or ₹2000 (or even ₹500) right after your salary is credited.

Pro Tip:

Open a separate savings account without debit card access — so you’re not tempted to withdraw.

4️⃣ Cut Back on Hidden Expenses & Subscriptions

It’s easy to forget about that ₹299 OTT subscription or gym membership you haven’t used in months.

Do a quarterly audit of your:

- Subscriptions (Netflix, Amazon, Spotify)

- Apps with recurring charges

- Credit card services & insurances

Actionable Tip: Cancel what you don’t use. Shift to shared plans wherever possible.

5️⃣ Explore Side Income Options (Even Small Ones Count)

In 2025, side hustles aren’t just for extra cash — they can be game changers. Here are some realistic options:

- Freelancing on platforms like Fiverr or Upwork

- Part-time online teaching

- Content writing or virtual assistant gigs

- Selling handmade products or digital services on Instagram

Even earning ₹5000 a month extra can create a saving habit and reduce your financial stress.

6️⃣ Be a Smart Spender — Cashback, Discounts & Offers Are Your Friends

Don’t fall for marketing traps, but do use smart offers:

- Use cashback apps like CRED, Paytm, PhonePe

- Look for bank offers on shopping

- Use credit cards wisely for reward points (pay full amount every month)

- Prefer buying during sales or using coupons

7️⃣ Start Small with Investments — Let Your Money Work for You

You don’t need lakhs to start investing. Begin with simple, low-risk options:

- Recurring Deposits in banks or post office

- Mutual Fund SIPs starting at ₹500/month (use trusted apps like Groww or Zerodha)

- PPF Accounts for long-term savings

Investing small amounts consistently beats saving large amounts occasionally.

Bonus Tip: Build an Emergency Fund

Aim to save at least 3 months of essential expenses in a liquid account. This protects you from unexpected events like job loss or medical emergencies.

Conclusion: Your 30s Are the Right Time to Build the Habit of Saving

You don’t need to earn big to start saving — you need discipline, a plan, and the right mindset.

Start with what you have, automate your savings, and avoid lifestyle inflation.

Remember, it’s not about how much you save once — it’s about how consistently you save over time.

Your Turn — Share with Me!

What’s your favorite saving tip that works on a tight budget? Share it in the comments or write an email to us.